Chemistry of the crisis

The current credit crisis of the US is different in many ways. The fact of being the US economy experiencing this means the world economy is also at stake. India is no exception.

Market economy is the engine of growth, and cash is the fuel. Credit is a major valid instrument to make available this fuel of free economy. So a crisis of credit is very natural to such an economy. The current credit crisis in the US has almost made credit crisis a mutant monster. There have been many countries that have faced such crisis in the past. Why is that so much of concern for the current credit crisis? The current crisis is fundamentally of different in nature in five significant ways:

- The crisis has originated from the economic super power. US economy impacts almost all countries in the world.

- The crisis was triggered by collapses of some of the largest and robust financial institutions in the world, which led to breakdown of basic risk management with pernicious financial consequences.

- The credit crises were not impelled, transferred and fueled by defaults on widespread debt instruments as in past credit crises but through excessive leverage (borrowing) and widespread securitization of complex structured financial products by large financial institutions. The leverage augmented even small changes in real risk associated with underlying debt instruments, which were transmitted globally via securitization, resulting in rapidly spreading and at times largely uncontained risk.

- Regulatory and accounting mechanisms for identifying, monitoring and quantifying and controlling excessive exposure to credit risk were at best ineffective and at worst outright failures raising fundamental questions regarding the current nature and form of regulation, its adequacy as well as necessary proscriptive changes to prevent such collapses in the future. Liquidity concerns also loomed large.

- Conventional economic policy tools (such as centeral bank interest rate reductions and fiscal stimulus initiatives) were not capable to manage credit and liquidity crises and are therefore are of limited effectiveness.

Origion of credit crises

It originated with sub-prime loan crisis. The sub-prime loans are loans which are given to borrowers with low credit scores. These are the loans which are granted at interest rates above the prime lending rate. These borrowers are subject to sub- prime lending on their defaults in credit card payments or any other type of credit default or delays. It originated with sub-prime loan crisis. The sub-prime loans are loans which are given to borrowers with low credit scores. These are the loans which are granted at interest rates above the prime lending rate. These borrowers are subject to sub- prime lending on their defaults in credit card payments or any other type of credit default or delays.

According to US standards these are people who have FICO score less than 620. A FICO score is a credit score developed by Fao Isaac & Co. credit scoring method of determining the likelihood that credit users will pay the bills. Credit scores analyze a borrower’s credit history considering number of factors such as:

- Late payments

- The amount of time credit has been established.

- The amount of credit used Vs amount of credit available.

- Length of time at present residence.

- Nature of credit information such as bankrupts, charge offs etc.

There are three FICO scores to be computed by data provided by each of the three bureaus- Explain, Trans Union and Equifax. Some lenders use one of these three scores, while other lenders may use middle score.

How this sub - prime loans came into being?

If we rewind ourselves to 2000, it is to be noticed that after the tech bubble burst and fears of 9/11 attack in 2001 , federal reserve began to cut rates drastically and federal funds rate reached at 1% in 2003 , which in central banking idiom is essentially zero. The overall idea of federal behind these rates cut was to prevent economy going into depression and to increase money supply to encourage borrowing, which would spur investment and spending. This led to aggressive lending by banking and financial institutions. However there was a good proportion of demand from sub- prime borrowers. So naturally when banks lend to them, it was with the pleasing knowledge that interest rates would be higher for this class of loans.

Every individual aspires a dream of having his own house. Americans were no exception to this. These low interest rates and increased liquidity increased demand for housing, which led to continuous growth in the market value of these assets (i.e. real estate), which was the collateral for the debt. Another angle is that the average American is highly debt-oriented, and resultantly, refinance is fairly commonplace in the US. In order to capture the market, banks began to value these assets higher and higher, as a higher valuation meant a higher loan amount which could enable them to win a deal over competition. This higher valuation also had an impact on the real money-value of the asset.

What was the role of investment banks?

First let's see here what investment banking is and how it is different from commercial banking:

Investment banking is a field of banking that aids companies in acquiring funds. In addition to the acquisition of new funds, investment banking also offers advice for a wide range of transactions a company might engage in. A majority of investment banks offer strategic advisory services for mergers, acquisitions, divestiture or other financial services for clients, such as the trading of derivatives, fixed income, foreign exchange, commodity, and equity securities. Investment banking is a field of banking that aids companies in acquiring funds. In addition to the acquisition of new funds, investment banking also offers advice for a wide range of transactions a company might engage in. A majority of investment banks offer strategic advisory services for mergers, acquisitions, divestiture or other financial services for clients, such as the trading of derivatives, fixed income, foreign exchange, commodity, and equity securities.

Now let's see how this whole cycle worked:

Our story begins with an American, who like evrybody else has a dream to own a house. Now in order to fulfill his dream he seeks for a home loan. However his credit history is poor. But things become easy for this American with the advent of sub-prime loans (explained above).

The above illustration in brief explains what exactly happened in term of a cycle. It started with:

- A sub-prime borrower (in our story American) takes a mortgage from institution like Well Fargo Home mortgage at 2/28 ARM terms.

- As soon as deal is signed these instructions package these mortgages into MBS (mortgage backed securities) and sell them off to other financial institutions like investment banks (Lehman brother, Morgan Stanley, etc).

- The banks then proceed to securitize these loans, chop them up, and package them into products called CDOs or Collateralized Debt Obligations which entitle the holders to the cash flows from the underlying mortgages.

- These CDOs are then sold to other market participants like hedge funds, pension funds, other banks and insurance companies based all over the world.

- The CDOs may then be traded like any financial security and thus ended up being held by banks and other market participants all over the world.

The question revolving in your mind now would be why financial institutions would buy loans of sub-prime borrowers. Here comes the role of rating agencies:

A lot of criticism has been directed at the rating agencies and underwriters of the CDOs and other mortgage-backed securities that included sub-prime loans in their mortgage pools. Some argue that the rating agencies should have foreseen the high default rates for sub-prime borrowers, and they should have given these CDOs much lower ratings than the 'AAA' rating given to the higher quality tranches. If the ratings had been more accurate, fewer investors would have bought these securities and the losses may not have been as bad. The argument is that rating agencies were enticed to give better ratings in order to continue receiving service fees, or they run the risk of the underwriter going to different rating agencies. However the flip side is that it’s hard to sell a security if it’s not rated.

How this situation led to financial fiasco?

With the coming of these sub-prime loans for few years things went pretty well as with low interest rates economy started to surge upwards resulting in value of real estate assets touching the sky. This situation made it easy for borrowers to make payments, in case they did run into troubled waters they could top-up their loans, or re-finance their loans at more favorable terms. So this was kind of happy –go lucky times for financial institutions. With the coming of these sub-prime loans for few years things went pretty well as with low interest rates economy started to surge upwards resulting in value of real estate assets touching the sky. This situation made it easy for borrowers to make payments, in case they did run into troubled waters they could top-up their loans, or re-finance their loans at more favorable terms. So this was kind of happy –go lucky times for financial institutions.

However as in case of every bollywood movies good times are snatched away by villains, something like this happened in US financial markets. The slowdown began in late 2006 and early 2007. With fast growing economy, money started to flow in to equities and money supply reduced. Following such a scenario FED started to increase interest rates. This situation made re-financing of loans by borrowers difficult. As loans became more expensive, the demand for housing reduced, leading to a reduction in the value of the asset. Now this led to a chaotic situation, where borrowers began to default on their loans at an alarming rate. The investing institutions who held the securities backed by this debt stood to loose.

These financial crises plagued like anything all over the economy. In this hue and cry banks stopped lending to each other. Most investment banks and hedge funds had to write down the value of their holdings or liquidate other investments to meet redemptions. With CDO prices at rock bottom levels, market players were forced to borrow heavily.

This led to a huge liquidity crunch in the global markets and subsequently runs on and the collapse of a few banks in Europe. With nobody ready to lend money, overnight rates in the money markets skyrocketed setting the stage for further runs on banks and even the freezing or possible collapse of the entire banking system.

This shows that US housing is now in freefall. The crisis is so severe that many economists have said these are the worst crisis since the Great Depression.

- If we go by financial figures the estimated losses on US mortgage defaults turn out to be between $750 -1200 billion.

- Defaults on such degree can lead to people not paying back their credit cards bill, car loan, mortgage etc. Bad loans could total $1700-2200 billion, a level comparable three fold to the debt that paralysed the Japanese banking system for a decade after 1989.

- OECD (organization of economic cooperation and development) has predicted prolonged slowdowns in countries like US, Britain, Germany, Japan and Canada coupled with strong slowdown in emerging countries like China, India and Russia.

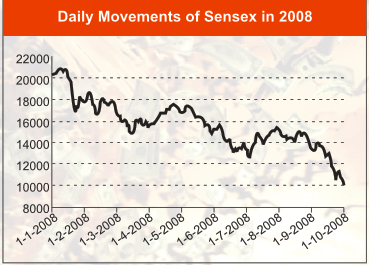

- However in totality it's the ordinary people who are prime victims of this credit crunch. Foreclosure filings in the US - forced home repossessions - were 121 percent higher in the second quarter of this year compared to the same period last year. Some 27,100 homes were repossessed in Britain last year. But the Council of Mortgage Lenders predicts this figure will rise by 65 percent this year, taking the total to 45,000. It expects 170,000 mortgages to be in arrears of more than three months by the end of 2008. The first half of the year saw 9,150 being repossessed - a rise of 41 percent compared to the same period last year.

How is India affected?

As many times witnessed when US sneezes other nations catches cold. This time is no exception. With global crises originated in USA, have spread their wings in other nations also. In recent days we have hearing lot of news our finance minster that India is immune to global financial turmoil. No doubt that India is fundamentally the strongest in comparison to other emerging economies but to say its immune from current crisis would be false. After a long phase of growth, Indian economy is now facing a downturn, which is being reflected from low IIP (index of industrial production) numbers, downgrading GDP figures, rupee depreciating and bearish mood of the stock markets. As many times witnessed when US sneezes other nations catches cold. This time is no exception. With global crises originated in USA, have spread their wings in other nations also. In recent days we have hearing lot of news our finance minster that India is immune to global financial turmoil. No doubt that India is fundamentally the strongest in comparison to other emerging economies but to say its immune from current crisis would be false. After a long phase of growth, Indian economy is now facing a downturn, which is being reflected from low IIP (index of industrial production) numbers, downgrading GDP figures, rupee depreciating and bearish mood of the stock markets.

Impact on stock markets

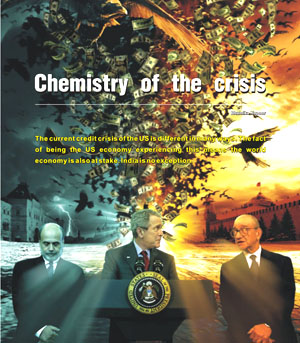

The Bombay stock exchange (BSE) sensitive index touched 20,000 points in October 2007. By October 2008, it dipped to 9000. The market which was touching heights last year is now near its bottoms. The crisis whose genesis lies in US has started showing its effects on Indian stock exchanges. The dip in stock market had been very fast.

If we rewind ourselves to last year, the factor that bestowed the overflow of liquidity into system was strong FII and capital inflow, which in turn led to appreciation of rupee , growth etc. But last few months have witnessed changes in global market dynamics in substantial way. The global sub-prime crisis , which have created an atmosphere of uncertainty have impacted Indian markets in an indirect way, leading to sucking out of liquidity from Indian markets in terms of reversal of FII and capital flows and putting pressure on rupee. These FII’s who need to retrench assets in order to cover losses in their home countries and seeking safety net in uncertain environment, have become major sellers in Indian markets. If we rewind ourselves to last year, the factor that bestowed the overflow of liquidity into system was strong FII and capital inflow, which in turn led to appreciation of rupee , growth etc. But last few months have witnessed changes in global market dynamics in substantial way. The global sub-prime crisis , which have created an atmosphere of uncertainty have impacted Indian markets in an indirect way, leading to sucking out of liquidity from Indian markets in terms of reversal of FII and capital flows and putting pressure on rupee. These FII’s who need to retrench assets in order to cover losses in their home countries and seeking safety net in uncertain environment, have become major sellers in Indian markets.

In 2007-08 net FII inflows into India amounted to be around $20.3 billion. In comparison to this, due to this uncertain global scenario they pulled out $11.1 billion during first nine and half months of fiscal year 2008 , of which $ 8.3 billion occurred over the first six and half months of financial year 2008-09 ( April 1 to October 16).

The above chart portrays the importance of FII’s in the Indian stock markets, given the fact that cumulative investments by FII’s stood at $66.5 billion at the beginning phase of the calendar year, the pullout triggered a huge downfall of stock prices. The outcome of this was sensex falled from its peak of 20, 873 on January 2008 to less than October 17, 2008, to less than 9000 by October 17, 2008.

Depreciating rupee

This pullout of funds by FII’s led to pungent depreciation of rupee. In between the period of January 1 and October 2008, the RBI reference rate for the rupee fell by nearly 25%, even relative to a weak currency like the dollar, from Rs 39.20 to the dollar Rs 48.86. This was despite of sale of dollars by RBI, which was reflected in decline of$ 25.8 billion in its foreign currency assets between the end of March 2008 and October 3, 2008. Though this depreciation of rupee turns out to be boon for Indian exports that are adversely hit by bad global sentiments, but it’s the opposite for those who have accumulated foreign exchange payment commitments.

Exposure of Indian banks

Another route from which this global setback can offset India’s high growth trajectory is through exposure of Indian banks or banks which are operating in India to the afflicted assets resulting from these subprime crises. RBI has claimed that exposure of Indian banks to assets impaired by financial crisis is small. According to reports RBI has estimated that due to the exposure of Indian banks to collateralized debt obligations the mark to market losses of Indian banks at the end of July was around $450 billion. Another route from which this global setback can offset India’s high growth trajectory is through exposure of Indian banks or banks which are operating in India to the afflicted assets resulting from these subprime crises. RBI has claimed that exposure of Indian banks to assets impaired by financial crisis is small. According to reports RBI has estimated that due to the exposure of Indian banks to collateralized debt obligations the mark to market losses of Indian banks at the end of July was around $450 billion.

Given the aggressive strategies adopted by the private sector banks, the MTM losses incurred by public sector banks were estimated at $90 million, while that for private banks was around $360 million. As yet these losses are on paper, but the RBI believes that even if they are to be provided for, these banks are well capitalised and can easily take the hit.

Liquidity crunch

Another factor which has added on to the fear of slow growth of Indian economy is the liquidity crises India inc is facing. Due to volatility in Indian financial environment, banks and financial institutions in order to protect losses in their balance sheet have started to cutback on creation of credit to housing, automobile and retail credit to individuals.

|

Retail Credit Growth

|

| |

Year up to June ( Rs cr) |

YOY growth in % |

| |

2007 |

2008 |

|

| Housing Loans |

2,30,700 |

2,59,000 |

12.27% |

| Personal Loans |

1,61,000 |

1,93,000 |

19.88% |

| Auto Loans |

86,000 |

87,000 |

1.16% |

| Credit card |

21,000 |

30,000 |

42.86% |

| receivables |

|

|

|

| Consumer durables |

6000 |

4000 |

-33.33% |

The above table highlights the retail credit growth under various sectors. It shows that loans to consumer durable segment decreased from around Rs 6000 crores in the year to June 2007, to a little over Rs 4000 crores to June this year. Direct housing loans which had increased by 25% during 2006-07, decelerated to 11% growth in 2007-08 and 12% over the year ending June 2008.

It is only the area of credit card where banks are unable to control the growth of credit. It expanded @ of 43% by the year ending 2008, slightly lower than previous year growth of 50%.

It’s a well known fact the key drivers which have made India a high growth trajectory economy are credit financed housing investment and credit financed consumption. However due to muteness of lenders to increase their exposure in markets in which they are already overexposed and suspicion of increasing payment commitments in an uncertain economic environment on the part of potential borrowers , are tend to curb debt –financed consumption and investment. This can result in slowdown in growth at a significant rate.

Slowdown in Indian IT sector

As pointed out earlier this flight of recession from US and other advanced economies would also hit the Indian exporters and ahead in the race are Indian IT exports which earn about 60% of the revenues from US. If we just consider top five players who account for 46% of the IT industry revenues, around 58% of this revenue is contributed by US counterparts. Around 30% of the revenues are from financial services. As pointed out earlier this flight of recession from US and other advanced economies would also hit the Indian exporters and ahead in the race are Indian IT exports which earn about 60% of the revenues from US. If we just consider top five players who account for 46% of the IT industry revenues, around 58% of this revenue is contributed by US counterparts. Around 30% of the revenues are from financial services.

The main clients of Indian IT sector services are US BFSI (financial services and insurance sector) players. These players’ generated large outsourcing chunks, made Indian IT players learn from their experience, negotiated aggressively on pricing, pushed for service level commitments and rewarded with more work to all who excelled in taking their challenges. Between periods of 1999 to 2008 the share of US financial services revenue as % of total revenue for the top 3 Indian IT players thus went up to 25% to 38%.

However the climate of global meltdown has forced these western companies to cut down on their IT spending by 43%. As we know international banks and institutions are sources of demand for these IT services and due to their downtrend sentiments they will cutback on their demand for such services. Apart from this nationalization of many of these banks is likely to increase pressure to reduce outsourcing in order to keep jobs in the developed countries. These financial crises in US have put question mark on the growth of Indian IT in short to medium term. And slowing of growth outside the financial sector will have implications for both merchandize and service exports. The net outcome of this would be slowdown in export stimulus and widening of trade deficit.

Impact of terror attacks on India Inc

Recent terror attacks in financial of the country Mumbai will post short term impact on Indian economy according to many economist and analyst. Being the home of Asia’s oldest stock exchange, country’s central bank, capital markets regulator (SEBI) and India’s biggest corporate houses- Tata’s , Birla’s , Ambani’s , accounts for country ‘s $ 1 trillion (Rs 49.9 trillion) economy and contributes one third of its direct taxes. According to various economists though these attacks will affect country’s economy but deeper impacts will come from global slowdown.

The business confidence which was weakening due to current global turmoil will now bear the heat of this terror attack, with sentiments further going weak. The hardest hit industries will be hospitality, travel and tourism and luxury retail business. Already tourism sector is struggling to beat economic slowdown, now these terror attacks have added to their struggle with hoteliers are expecting large scale cancellation of bookings mostly from overseas visitors. This will in turn affect the aviation business which is already in battle with the slowdown. Another immediate victim of this attack would be luxury retail business. The Taj and Trident are home to around a dozen of luxury retailers including Gucci, Ferragamo, Jimmy Choo, Estee Lauder, Louis Vuitton and Fendi. Business would be impacted not only due to space but also sales because lot of sales comes from in-house guests. Most luxury brands prefer to operate out of five star hotels because India doesnit have high quality luxury retail space.

Macro –economic indicators for future

The world economic forum and Confederation of Indian Industry suggest that Indian economy is likely to expand by 7.4-7.8% during fiscal 2008-09, lower than 9% of last year due gloomy global economic conditions. The report also suggest that downturn will hit the economy more in 2009 and government needs to speed up reforms and boost investments in order to maintain high growth trajectory.

Despite of such a dim picture of Indian economy recent data of RBI suggests that bank deposits are growing at the rate of 23%. , non-food credit is growing at 26% and credit deposit ratio is 73%. Banks can only lend 5% of the asset base as collateral. Hence even if collateral value crashes by 50%, impact on bank credit is insignificant. Indian banks are well capitalized and the bank assets to GDP ratio is relatively low at 55% as compared to that of 150% of their global peers.

The long term liquidity picture seems to better due to the following:

- Release of Rs 60,000 crores in the system on the account of the CRR cut.

- The liquidity-adjustment facility (LAF) also provides liquidity and as on October 10 2008, Rs 91,500 crore has been accessed by banks through LAF window.

- Release of Rs 25,000 crores as the first installment of the farm loan wavier.

- Release of Rs 42000 crores from the fertilizer loans and pay commission awards.

All of these measures would contribute to about Rs 218,500 crore in all. In addition to this government spending in the next 2 quarters is expected to be huge at Rs 471,280 crore from total Rs 750,884 crore planned for budgetary allocation for this fiscal.

In conclusion it can be said that one can learn a lesson from such crises, global problems require of a global solution. This century would be shaped by how countries can respond to the global economic crises today. It has already seen that debt financed consumption as well as external sector currently is not able to boost demand in the economy. This demand boost can however be provided by the Government if it takes upon itself the task of injecting demand into the economy through higher Government expenditure. Due to the outcome of the policies of government corporate sector rose to the stature of dominant sector in the economy. With the private sector in a crisis of its own, in the absence of Government boosting demand, the conditions of the people will further worsen. It is time to look back to economist John Maynard Keyenes theory for state intervention to boost demand.

United Liabilities of America

Will the US fail? It is a question that we don’t ask often as we can’t imagine an answer. Yes, it is true that the US is too big to fail. But when the super structure’s foundation becomes shaky anything can happen.

The US is huge and unimaginable in its influence over world economy. Its GDP is USD 14 trillion, 14 times of India’s. Americans consume more than USD10 trillion every year. Its 120 million of housing units are worth USD 18-19 trillion in a total population of 300 million. Its equity market capitalization is more than USD11 trillion. The country’s household net worth is of USD50 trillion. Simply unimaginable wealth!

But also look at the other side of the coin. Total credit market debt of USD 50 trillion against the annual gross national savings of USD 1.5 trillion and net national savings close to zero. Personal disposable income of USD10 trillion and household liability of USD 13 trillion in home mortgages and consumer credits against personal savings as a percentage of disposable income close to zero. Incredibly high debt!

Compare these figures with total world GDP of USD 54 trillion. The only comparable economy with that of USA in terms of size is Euro with GDP of Euro 13 trillion. You may be bored by this number crunching but they are essential to understand the gravity of the current on-going problems faced by US and world economies. As Keynes wrote, "When disillusion falls upon an over-optimistic and over-bought market, it should fall with sudden and even catastrophic force."

Past-script of the problem: US Fed had loosened its monetary policy in 2000-2001 to save the US economy from bursting of the tech bubble. The aggressive actions by US Fed then in 2000-2001 made US growth back on track with a very brief recession but started brewing multiple bubbles due to easy availability of credit. In subsequent period consumer credit (sub-prime and Alt-A housing loans) was available to those who were not qualified to take those loans in terms of their risk profile. Banks had started lending for housing loans with closed to zero percent equity from borrower and Securitization of those mortgages loans increased the velocity of credit. Investment bankers also jumped in the business as a shadow bankers with a leverage of 25-30 times compare to leverage of 10 times seen in normal commercial banking.

The housing crisis: This had fueled a housing boom. Home mortgages held by US household almost doubled from around USD 5.5 trillion in 2000 to USD 10.6 trillion by 2008. US housing prices as measured by S&P/case-shiller index CSXR-SA on average increased by 8 percent during 2002-2008 period compare to average 4 percent growth seen during 1987-2001 period. Some US household even started using their houses as ATM as higher housing prices allow them to use their home equity credits for their consumption needs. Things were fine as far as housing prices were going up. But tide started turning around summer of 2006. Huge supply of new homes was coming and buildup of inventory was inevitable at some point and these started a correction in housing prices. By January 2007, S&P/case-shiller index CSXR-SA had started declining y-o-y with y-o-y decline reaching double digit by end of 2007. US entered into a housing recession. It was inevitable that home prices need to fall by 25-30 percent from their peak of 2006 and remain there for quite some time to reach the historical equilibrium growth rate of 4 percent. Many home loans in sub-prime and Alt-A category started turning into a negative incentives. With littler incentives for home owners (whose risk profile was not qualified enough for loans) to keep paying mortgages in falling housing price scenario, defaults started to increase in sub-prime housing loans market.

Credit crisis sets in: Banks and investment banks operating as a shadow bankers started reporting losses on home mortgages. First to affect was investment bankers who were highly leverage so they went to equity market to raise capital. However, equity and credit markets eventually smelled the problem and re-priced the risk accordingly. It became a lot more difficult for bankers and investment bankers to sell their mortgage baked commercial papers and to raise equities to shore up their books as markets became more skeptical about their exposure to sub-prime market, their future losses, etc. Securitization market was almost closed as buyers were not willing to buy the securitized products due to heighten risk aversion. In a way, velocity of credit dried up very fast and many instruments in credit markets became illiquid. US Fed started acting actively in the market with easy monetary policy and liquidity infusion. Meanwhile, housing prices kept on falling fueling further risk aversion leading to lack confidence amongst the market participants. Shadow banking run by investment banker was dead (Bear Sterns was sold, Lehman failed and Morgan Stanley & Goldman converted themselves into commercial banking). As per the estimates by many renowned agencies and economists, credit losses on various credit instruments (home mortgages, credit cards, commercial real estate, corporate loans, etc) is likely to be in the range of USD 1.5 trillion to USD 2 billion with only around USD 900 billion of losses recognized so far.

Economic damages: During the period of 2000/01-2006/07, most of the central banks were having expansionary monetary policy. Credit was easily available and that coupled with higher risk appetite amongst the investors fueled many bubbles. Capital was flowing into many EM economies as never before. Commodities were running at multi-year highs. Emerging market economies were growing above their structural & potential growth rates due to easy availability of foreign capital, higher commodity prices and strong US consumption. Equity markets were also reached multi year highs in late 2007/early 2008 discounting robust growth outlook all over the world. All boats were lifted in a tide of easy credit. Higher commodity prices - partly due to genuine demand-supply mismatch and partly due to speculation - resulted into higher inflation and inflation expectation forcing central banks all over the world to come back into tightening mode. Liquidity was tightened in many EM economies and interest rates were raised. Credit became costly in some economies - but nothing wrong till growth outlook is robust. Economic damages: During the period of 2000/01-2006/07, most of the central banks were having expansionary monetary policy. Credit was easily available and that coupled with higher risk appetite amongst the investors fueled many bubbles. Capital was flowing into many EM economies as never before. Commodities were running at multi-year highs. Emerging market economies were growing above their structural & potential growth rates due to easy availability of foreign capital, higher commodity prices and strong US consumption. Equity markets were also reached multi year highs in late 2007/early 2008 discounting robust growth outlook all over the world. All boats were lifted in a tide of easy credit. Higher commodity prices - partly due to genuine demand-supply mismatch and partly due to speculation - resulted into higher inflation and inflation expectation forcing central banks all over the world to come back into tightening mode. Liquidity was tightened in many EM economies and interest rates were raised. Credit became costly in some economies - but nothing wrong till growth outlook is robust.

Structural difficulties: Without any shades of doubts one can say that US in not saving enough as a nation as well at consumer level. For example, US consumer is not saving enough to pay for installments and interest of its USD 13 trillion loans. Ideally, it should save 5-7 percent more of its disposable income of USD 10 USD to fulfill its obligations of consumer debts and to save for its future. This can happen in two ways: 1) The US consumption remains at the same level but their disposable income rises by 5-7 percent driven by growth elsewhere in the US economy or world. At present this scenario unlikely to work as Euro and Japan are already in recession and growth outlook of rest of the world is also pared down significantly, 2) by reducing consumption by 5-7 percent - This seems to be a natural fall out.

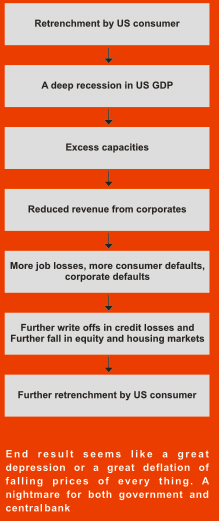

However, a 5 percent more savings in US consumption means a direct contraction of 3.5 percent of US GDP and may be another 3.5 percent indirect contraction of US GDP. In sum, a US GDP contraction of 7 percent over a period, however, not many renowned economists are expecting such a deep recession. But the solution is not as simple as it seems as a 5 percent retrenchment by US consumers might have more vicious effects

Can they save the economy?: US Fed is aggressively reducing fed rates and has announced massive liquidity injection/support programs of USD +3.5 trillion to get over the worst credit crisis faced by US in decades. US government has also announced massive packages worth of USD 1 trillion by way of tax rebates to consumers, direct equity infusion in troubled banks, implicit and explicit guarantee (mortgage giants Fannie and Freddie Mac are now more or less nationalized), etc. President-elect Barak Obama is also likely to announce another massive fiscal stimulus package of USD 500-750 billion. Will these measures help to bring US economy back from an expected deep recession or something worst then that? There are no easy answers and before we try to find any, let us discuss the structural fiscal problem faced by US Government. Can they save the economy?: US Fed is aggressively reducing fed rates and has announced massive liquidity injection/support programs of USD +3.5 trillion to get over the worst credit crisis faced by US in decades. US government has also announced massive packages worth of USD 1 trillion by way of tax rebates to consumers, direct equity infusion in troubled banks, implicit and explicit guarantee (mortgage giants Fannie and Freddie Mac are now more or less nationalized), etc. President-elect Barak Obama is also likely to announce another massive fiscal stimulus package of USD 500-750 billion. Will these measures help to bring US economy back from an expected deep recession or something worst then that? There are no easy answers and before we try to find any, let us discuss the structural fiscal problem faced by US Government.

Till last year, US government was running an annualized fiscal deficit of USD 500 billion. With recent announcements of massive stimulus packages, it is likely to increase to USD 800-1000 billion for a current and next year. And, if in short run, economic outlook really worsen, this figure is likely to go up as Governments revenue is likely to decline on back of consumer retrenchment. On longer term, US government is facing a huge shortfall on its promised social security and health benefits programs of US citizen. Expected shortfall is likely to be as high as USD +40 trillion in next three to four decades measured in current terms.

US consumer is not saving and on top of that it needs capital (which no body is going to provide now in gloomy outlook and heightened risk aversion). US Corporates are saving but that is used for internal consumption. So, who will provide so much money required by US government for its massive fiscal programs aiming to revive its economy? US consumer is not saving and on top of that it needs capital (which no body is going to provide now in gloomy outlook and heightened risk aversion). US Corporates are saving but that is used for internal consumption. So, who will provide so much money required by US government for its massive fiscal programs aiming to revive its economy?

Rest of world can provide its savings to US as they have done in past. US as a nation has borrowed USD 20 trillion during 2003-2008 period and rest of word (mainly countries like Japan, China, Gulf countries running a huge current a/c surplus in the world trade mainly dominated in US) has lend massive USD 5 trillion (~25% of US net borrowing) during the same period. However, with Japan, China and many Gulf countries has also started facing problems in their home countries due to growth concerns, how they will lend US this time is a big concern. And though US dollar generally outperforms in the time of deep crisis, investment in US government paper does not yield more then 3% in current times. If US government, if need arises, raise the interest rate of its paper to attract more capital in the US, it will back fire for US economy as it will further kill consumption capacity of a debt laden US consumer.

Another way is that US Fed can print US dollar on behalf of the government. This will lead to massive increased in US money supply (which is already gone by many times thanks to massive infusion of liquidity by US Fed). But, it can de base the USD, loose it appeal in long run, it can have hugely inflationary effects if economy revises a bit and bring many more problems which are beyond the scope of current discussion.

So where is the US economy headed? No definite answers. A smooth balancing of US economy’s structural imbalances to equilibrium will be a desire answer. But, a deep trouble in US economy will spell equal if not bigger troubles for the rest of world.

|